Synthetic positions through options

January 21, 2019 • 3 min read

Lately I've used the strategy of synthetic long positions through options. With the market downturn I want to get long some positions. But given the market volatility options prices are elevated. In addition, I don’t want to tie up a lot of capital by owning the underlying stock positions.

Nonetheless I am bullish. Although other strategies, like an options call spread, would mitigate the elevated options prices, it also caps potential gains. Again, I am bullish. With that said, not bullish enough to buy calls outright.

Enter the synthetic long strategy. This options trading strategy sells an at the money put, and buys an at the money call. The credit from the put helps finance buying the calls. If the stock goes up, you are long via the calls. If the stock goes down, you are still long through the puts (by selling put options, you effectively own the stock at that strike).

Now I slightly modified this to avoid the unlimited risk downside risk. I've done this mainly due to recent market volatility - that is the market could continue to move lower. As much as I would like to think I placed these trades near the bottom, I never have perfect timing. The market could move much lower.

With this modification, I sell an at the money put spread instead of a naked put. This still checks all the boxes.

This allows me to keep unlimited upside reward, while mitigating the unlimited downside risk. Although I do take in less premium, and therefore pay more to purchase the call, I find it a fair tradeoff given the current market.

- It allows me to get long a position through options so I don't have to risk a large amount of portfolio capital.

- I mitigate the elevated options pricing by selling a put spread, I one that's enough out of the money to allow some down side movement and possibly a shorter dated spread then my overall long call.

- I maintain unlimited upside reward, while limiting my downside risk.

Currently synthetic long positions

Apple

I bought the February $170 calls and sold the January $135/$130 put spread in AAPL. The opening trade cost $0.23. I recently closed the put spread into earnings for $0.17. The February calls are currently worth $0.93. I will likely take some profits by closing half the position before earnings.

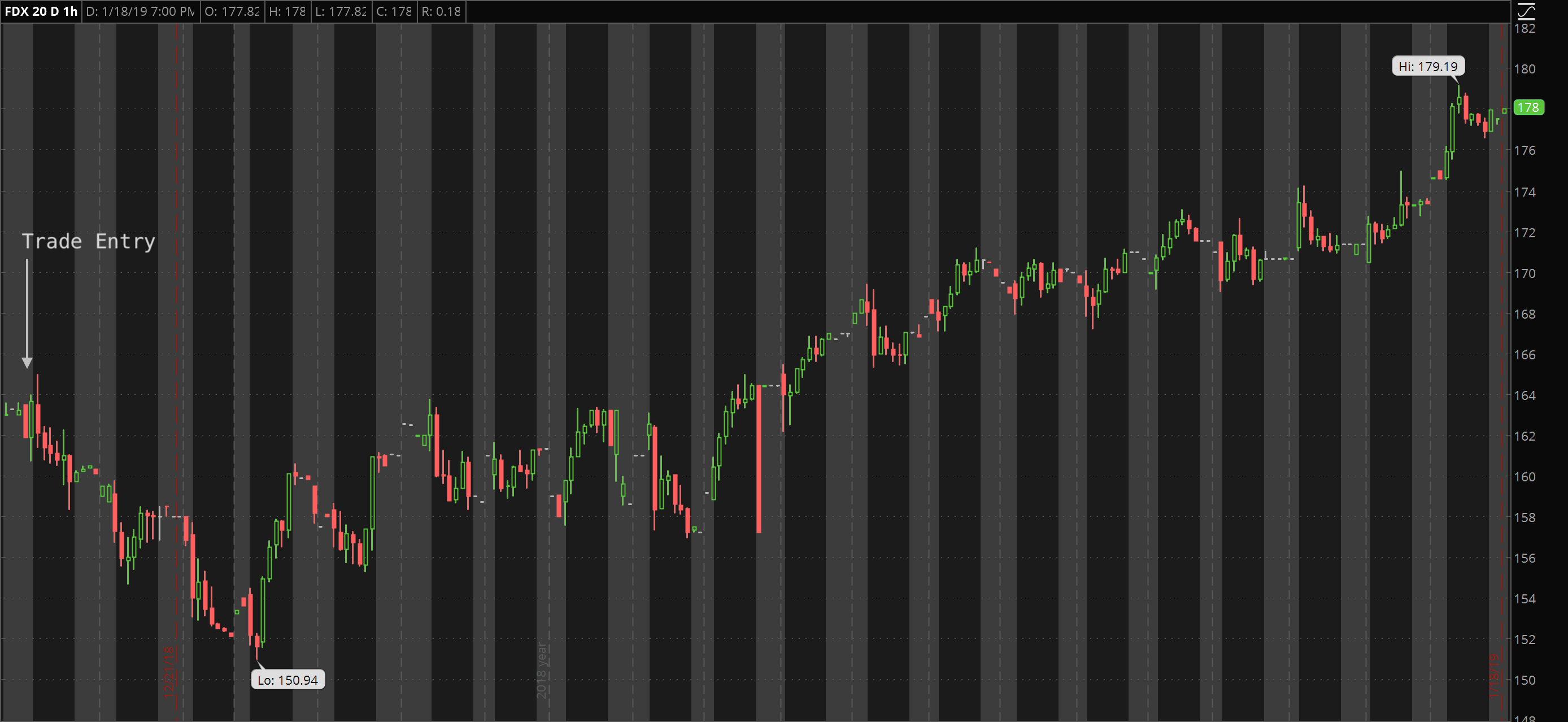

FedEx

I bought the February $200 calls and sold the January $155/$150 put spread in FDX. The opening trade actually provided a tiny credit of $0.02. The put spread expired worthless. Given the small credit I plan to let the calls ride into earnings.

Oil

I bought the March $62 call options and sold the January $55/$50 put spread in XLE. The opening trade cost $0.87. Given the run up, I sold the January $65 calls to recoup more of the cost basis. As those calls and the put spread expired worthless, I also sold 20% of my March $62 call options. The March $62 calls options are worth $3.20 and my cost basis is $0.59=. I plan to incrementally sell covered calls and exit the position as XLE continues up.

Find this interesting? Follow me on Twitter for even tips and trades.