Turn profitable by rolling options trades

January 16, 2019 • 6 min read

About a year ago I joined Option Alpha. I wanted to level-up my options trading strategies and after trying a few I landed on OA. The main reason was the free, educational video tracks. I actually watched all of them in a weekend. In fact, I am re-watching them now.

Admittedly I am still trying to synthesize their style with my own style of options trading. At the same time, for 2018, I tried to be respectful of their options trading strategies. I did not altered them in any way. When they sold, I sold. When they bought, I bought.

Here are a few things I learned after a year of following their options trades.

Balancing position size

I talked about before and learned it long ago from Jim Cramer's advice. I aim to keep my options trades in any one position less than 5% of my overall portfolio value. So, for easy numbers, if I have a portfolio balance of $100k, all options trades in a single position can't have more than $5k of risk.

Sounds easy enough as I write it, but it's not so easy to see when managing such an active options portfolio. OA makes dozens of options trades each month. They manage positions two and sometimes three months out. They adjust and roll positions. So there's a lot to track. I unknowingly was overweight XLE and SMH in December 2018 which resulted in a larger than ordinary loss.

Maintaining a neutral portfolio

The different neutral options trading strategies were new to me. These were condors, butterflies, strangles, and straddles. While I had read about them, I hadn't placed such options trades. Even if my outlook was indeed neutral, I was only placing unidirectional options trades. I'd sell calls or puts in a position, but never both. While these trades may have worked, I was leaving a lot of money on the table by not placing a truly neutral options trade.

Rolling for time and credit

The final strategy I learned, and the one I want to focus on today is rolling losing options trades for time and credit. I attribute this strategy solely to OA and have used it turned many losing trades profitable.

A lot of times when my options trades didn't play out I would take the loss. I assumed I got it wrong and potentially place a new options trade in the same position. However, although the trade lost for the current expiration there's potential for the same trade to be profitable for a future expiration. This, of course, provides more time to take advantage of market cyclicality. The rule being you can can only roll the trade for a net credit.

Let's look at a few examples.

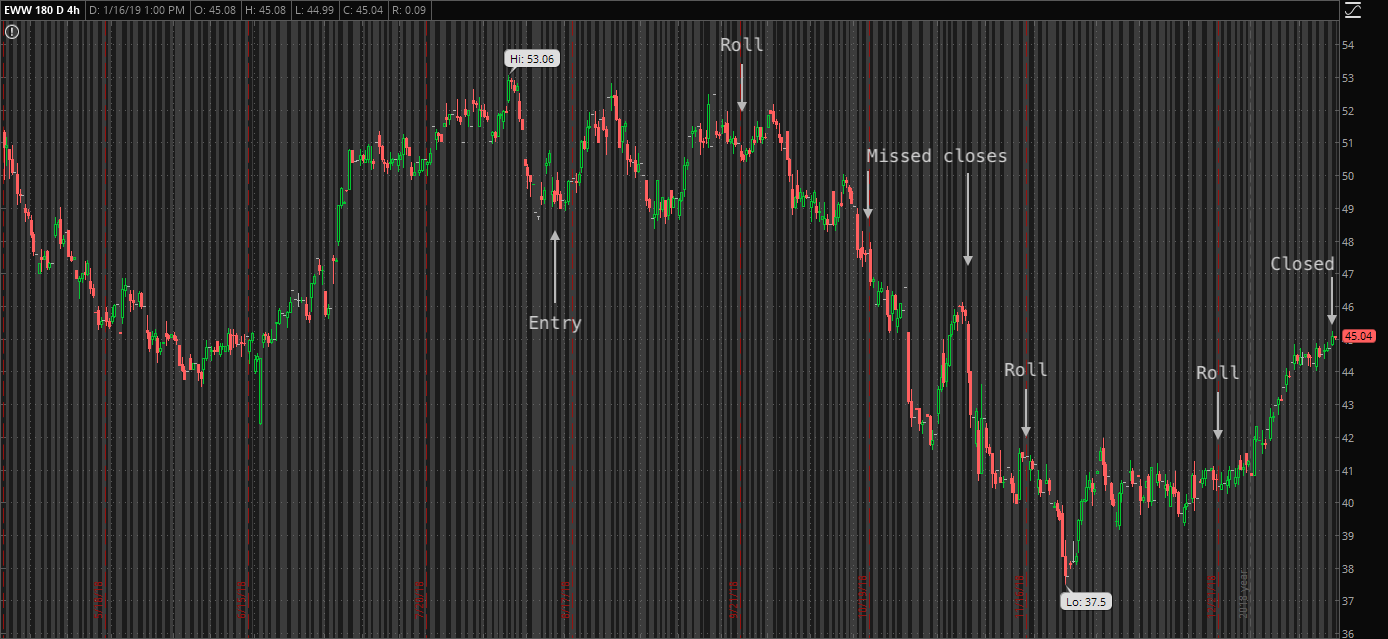

A straddle in EWW

First back in August I placed a straddle options trade in EWW at the $47 strikes. EWW had moved significantly up over the summer and I expected market cyclicality to bring EWW back in range. However, EWW continued to stay around $50 into September. So I rolled the straddle to October. Same strikes at $47 and took in $0.57.

Now with the markets decline starting in October this did revert to the mean, but did so very rapidly and I missed the opportunity to close the position at my profit targets. I admit, this was my fault due to lack of automation. Regardless, even if I did close the trade here it still demonstrates the turning the original losing trade profitable by rolling.

Since I didn't close the straddle, I rolled it to November for a $0.87 credit. EWW continued lower through November. So I again rolled to December for $0.15. In fact, I rolled from December to January for $0.01. That's right, a penny premium, but a credit nonetheless.

Now these credits seem rather trivial. But the reality is I'm actually getting paid to have more time. The combination provides market cyclicality as well as lowering my cost basis. The initial options trade brought in a $1.29 credit. But after rolling the position 4 times, the overall credit was $2.89.

With more market cyclicality at the beginning of 2019, EWW has now mean reverted back up. At the time of this writing it is trading at $45.13. I actually closed the position when it popped above $45 earlier this week for a $2.00 debit.

Instead of taking the loss back in September I was able to roll the position for more time and credit to allow for market cyclicality (inline with my original thesis). Although I missed the opportunity to close sooner back in October for a profit, I was still able to roll the position for a profit through another cycle. Had I given up and closed the position in November or December, I would have taken a $5 loss. Instead, I ended with a $0.89 profit.

As an aside, when I roll positions multiple times I consider them at risk. This means I want to close the position as soon as it's profitable. Given the current market uptrend I could allow EWW more time to continue higher. Don't get greedy, take the money and move on.

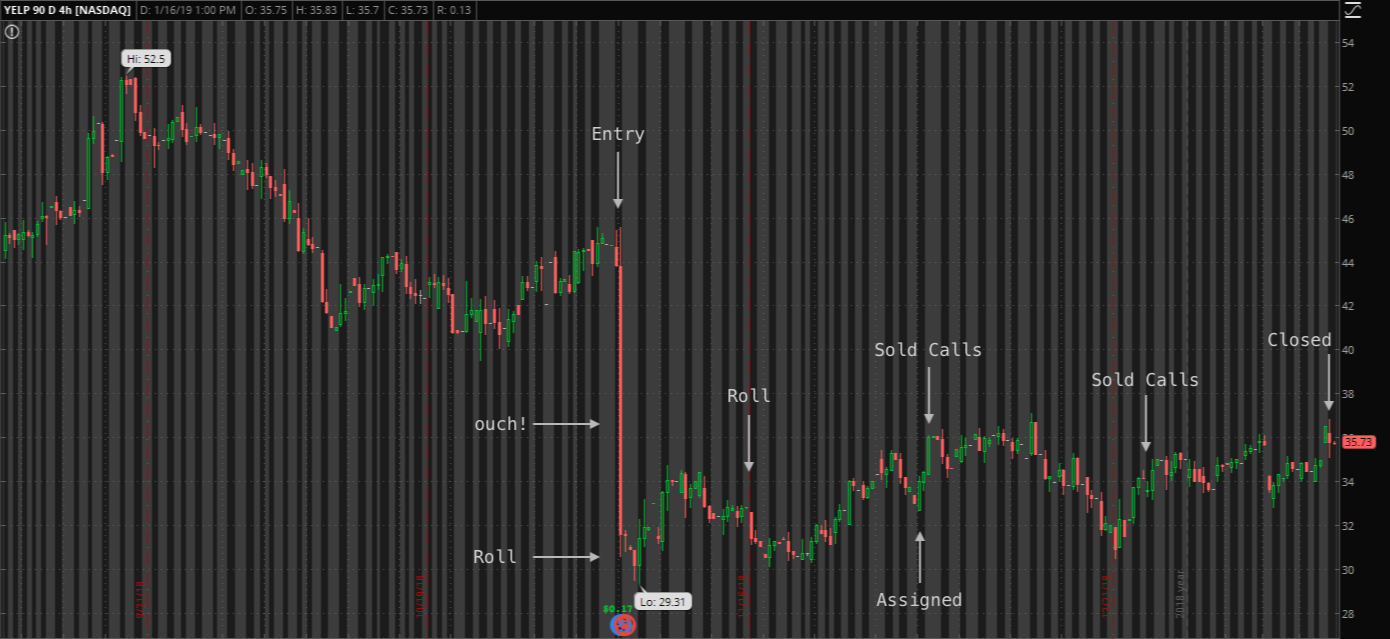

Earnings trades in retail stocks

Also in 2018 Q2 and Q3 I placed a few earnings trades in retail stocks. Given the recent moves I figured the implied volatility versus historic volatility gave me a slight edge in some directional strategies.

So I entered a put ratio spread in both M and YELP. Technically this is an unlimited risk trade, which I try not to do often. However given the strikes the stocks would have needed to quadruple the implied move after earnings.

Well, of course, they both did just that. In fact, YELP hit a new 52-week low immediately following earnings. I'll focus on YELP as it had the more dramatic move. Plus, I was willing to own the underly stock position in M at lower prices given their dividend.

At expiration, I closed the put spread for a full profit. I left on the second half of the short put and rolled for time and credit. At this point, YELP was trading around $30. I had the November put options at $38.50 strikes, for an overall credit of $2.82.

I continued to roll the position into December. The twist here is those put options were exercised and I was assigned YELP stock. While this was a drain on my portfolio given the higher capital required to hold the underlying stock position, since I had traded within my portfolio balance and these were lower share prices I was able to continue to hold these positions.

Since I could no longer roll the options, I instead starting selling calls against my underlying stock position. I sold the December $38.50 calls and then the January $38.50. I could have sold these at a lower strike for a larger credit. For example, I selling the $36 strikes since I already had an overall credit of $2.82. However, this would have forced a break even scenario instead of allow the position to turn profitable.

It has been difficult during the downtrend to hold the YELP stock position. Yet, even after assignment you can still benefit from this rolling strategy. YELP recently popped above $36 allowing me to close both the stock position and the January $38.50 calls for an overall profit of $1.07. Had I closed after the initial earnings trade, I would have lost $4.07.

Find this interesting? Follow me on Twitter for even tips and trades.