Automation in a volatile market

January 8, 2019 • 3 min read

In August I began placing credit spreads in the the Dow Jones Industrial Average and Russell 2000 ETFs. This was the exact options trading strategy outlined in the Options Alpha Podcast Episode 138.

To summarize each of the two options trades:

- Sell a DIA put credit spread 40 days to expiration at the 30 delta.

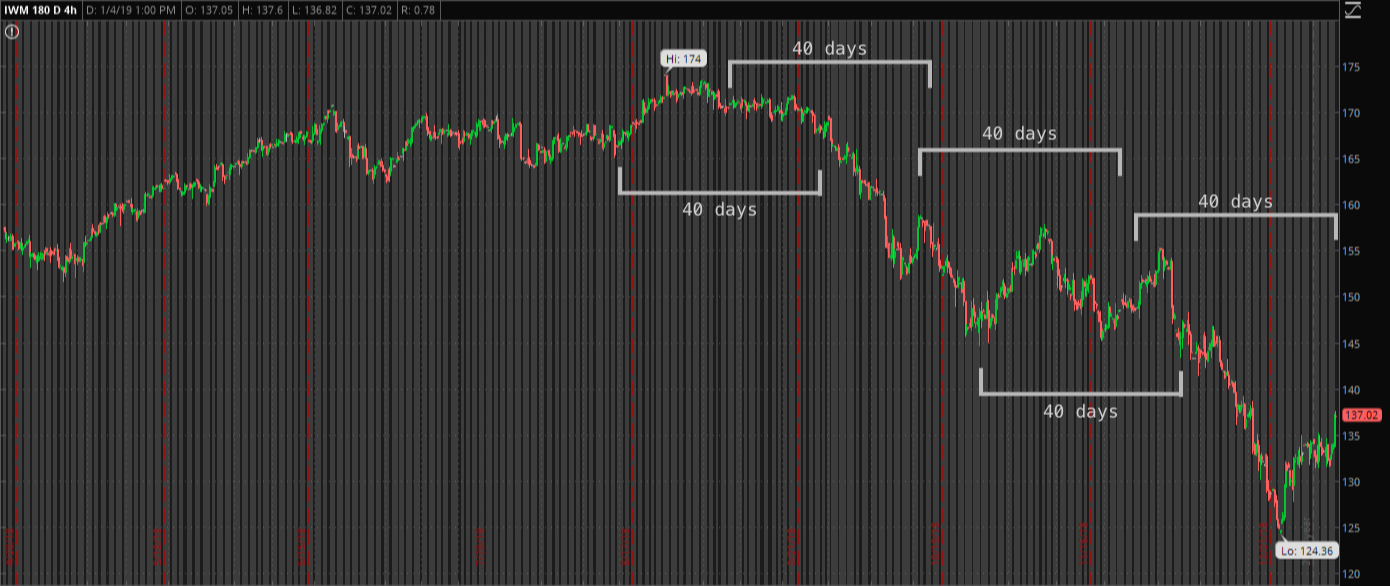

- Sell an IWM short strangle 40 days to expiration 20 delta.

As discussed in the podcast episode, through back-testing the optimal strategy is to close the DIA credit spread at a 75% profit and the IWM short at a 50% profit. Over the testing period, this yielded a return of 134% for DIA and 143% for IWM.

I started this strategy in August and it was working well into November. Now obviously with the precipitous and continual drop in the markets these neutral (IWM) and bullish (DIA) strategies were big losers in December.

Even with adjustments (converting IWM into an iron butterfly), I took full losses on both the IWM and DIA options trades. I was also constantly battling assignments. Even though my risk was defined and no more than 3% of my overall portfolio, the high stock price and multiple assignments didn't allow me to hold the underlying stock position for more than a day.

Now, you can't predict the markets. This was of course crappy timing. But if there's one thing I have learned in investing it's that I am never going to time a trade perfectly. This is actually why I liked these strategies. It wasn't just the lure of the returns, but their simple, mechanical structure. This was also, conversely, what made them difficult and taught me two lessons.

You have to keep playing

These strategies as outlined in the podcast were back-tested over the course of 10 years. So it's an average. An individual trade, month, or year didn't necessarily win or yield those high returns. If I stop trading now I lose the averages and simply walk away with a loss.

But markets are cyclic. They don't go straight down forever, just as much as they don't go straight up forever. I never stopped trading this strategy. I continued to open options trades 40 days out. In fact, with the pop last week I was able to exit some of the late January and early February positions at their profit targets. This is because I was placing trades during the lower market in December. So this strategy is constantly in motion.

Automated option portfolio management is crucial

Second, staying on top of these trades is incredibly challenging. It is absolutely critical to have each options position tracked. This is harder than it sounds with all the successive trades, not to mention adjustments, assignments, and rolling. I need to know my exact cost basis at any time in order to know my exit prices or how best to adjust the positions during a moving market.

As we saw at the end of 2018 markets can move quickly. I must automate trades to close the DIA positions at 75% profits and 50% profits in IWM. The pop up on December 4 after the weekend Trade Truce was a prime example where the short-lived rally provided a brief uptick which triggered closing orders in otherwise losing positions had I missed it.

Find this interesting? Follow me on Twitter for even tips and trades.