Being mechanical with options trades

January 28, 2019 • 2 min read

At the beginning of 2018 I joined Option Alpha. For the entire year, I tried to strictly follow their options trades. In doing so, I using placing some of my previous options trading strategies. I began trading options in 2014. Admittedly, there has been a bit of imposter syndrome. I didn't really feel like I knew what I was doing. Even though I had a few big wins to help keep me in the game, most were complete losers.

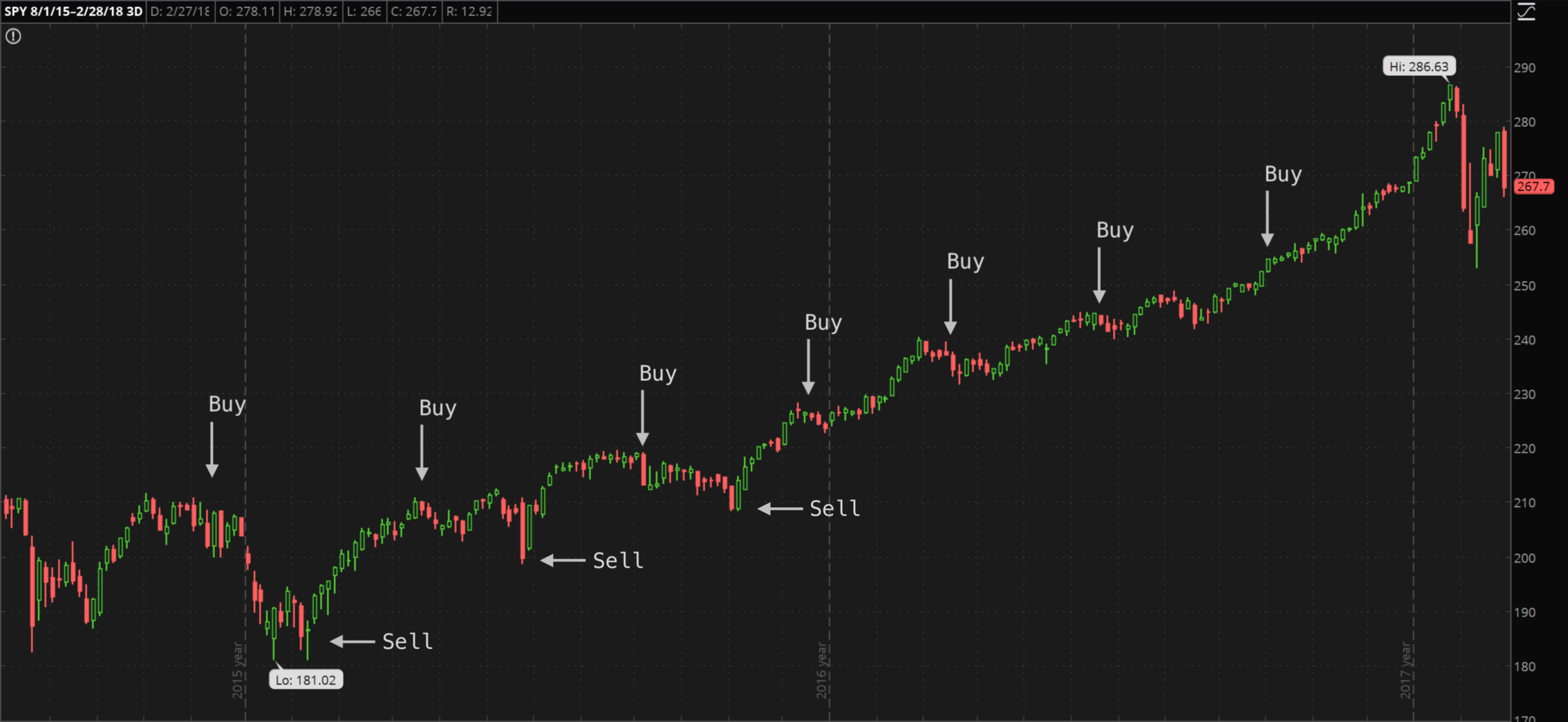

In the beginning my strategy was basic. Basically replacing long stock trades with call options. I really had no strategy. Eventually I adopted a strategy I first heard from Karen Finerman. She talked about buying protective puts. I did a little research and in August of 2015 I began buying SPY put options to protect my portfolio. There was a significant market pull-back in October 2015 and my protective puts paid off well. It did its job protecting my portfolio and it also hooked me on this strategy.

I continued to use protective puts in 2015 and 2016. So by the time I got into 2017 I started buying put options not only as a protection strategy, but also put calendar spreads to generate income. Admittedly I became overweight. And of course with the Trump rally for nearly all of 2017, none of these ended up paying off.

Now from the perspective of protective put they were serving a purpose. But because I was overweight from adding the debit put spreads, they actually did create a drag on my portfolio. Furthermore the constant calendar roll resulted in higher trade commissions.

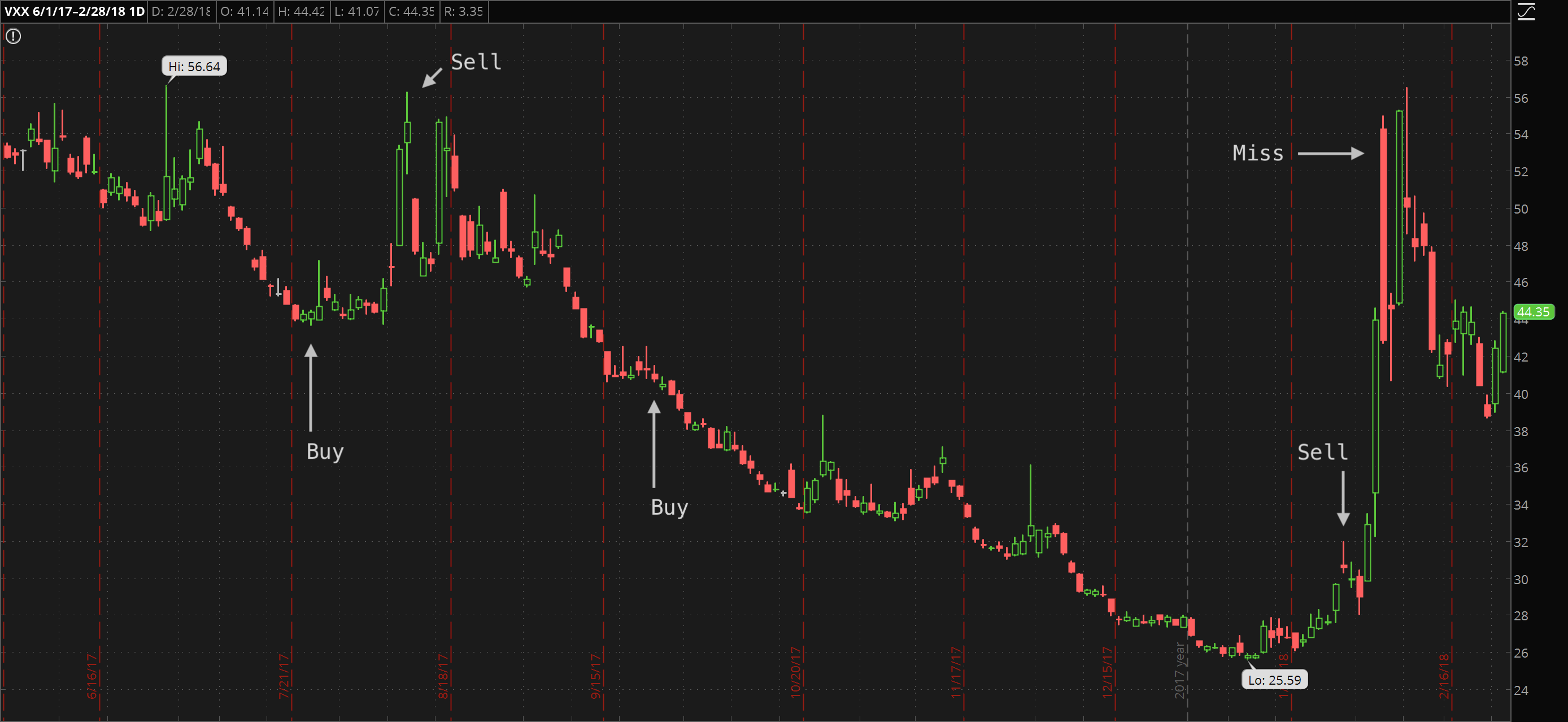

For accounts like my IRA where I don't trade options I added protection by owning the VIX through VXX. The unfortunately thing was I quit trading both of these options strategies in January 2018. The losses caused too much pain. Especially in the VXX with the higher capital requirement. Of course, as timing always seems to go, as soon as I sold these position the VXX tripled in value almost overnight during the February 2018 market pull-back.

Now this is a woulda coulda shoulda scenario. But nonetheless there are two lessons to be learned here. First I need to mix in my own options trading strategies. If I don't act on my own ideas, I will counteract them in one way or another. So the result is impulse, which leads me to my next lesson.

Second, I need to remain mechanical. I plan to continue to do quarterly protective puts at roughly 1% of the portfolio. Ideally, these puts are incrementally added as the market moves higher. Since I can’t predict the market, but do believe in it’s cyclicality, I will also help offset buying these protective puts by selling VXX call spreads when the market does move lower.

Find this interesting? Follow me on Twitter for even tips and trades.