Taking options trades to expiration

February 20, 2019 • 3 min read

Timing is hard. Honestly, I never seem to get it right. My tendency is to carry options all the way to expiration. Anecdotally this seems to work out, but this is likely just recency bias. So, this year I have tracked the options trades I carried all the way to expiration. Here are cases where doing so has paid off and doing so has lost money.

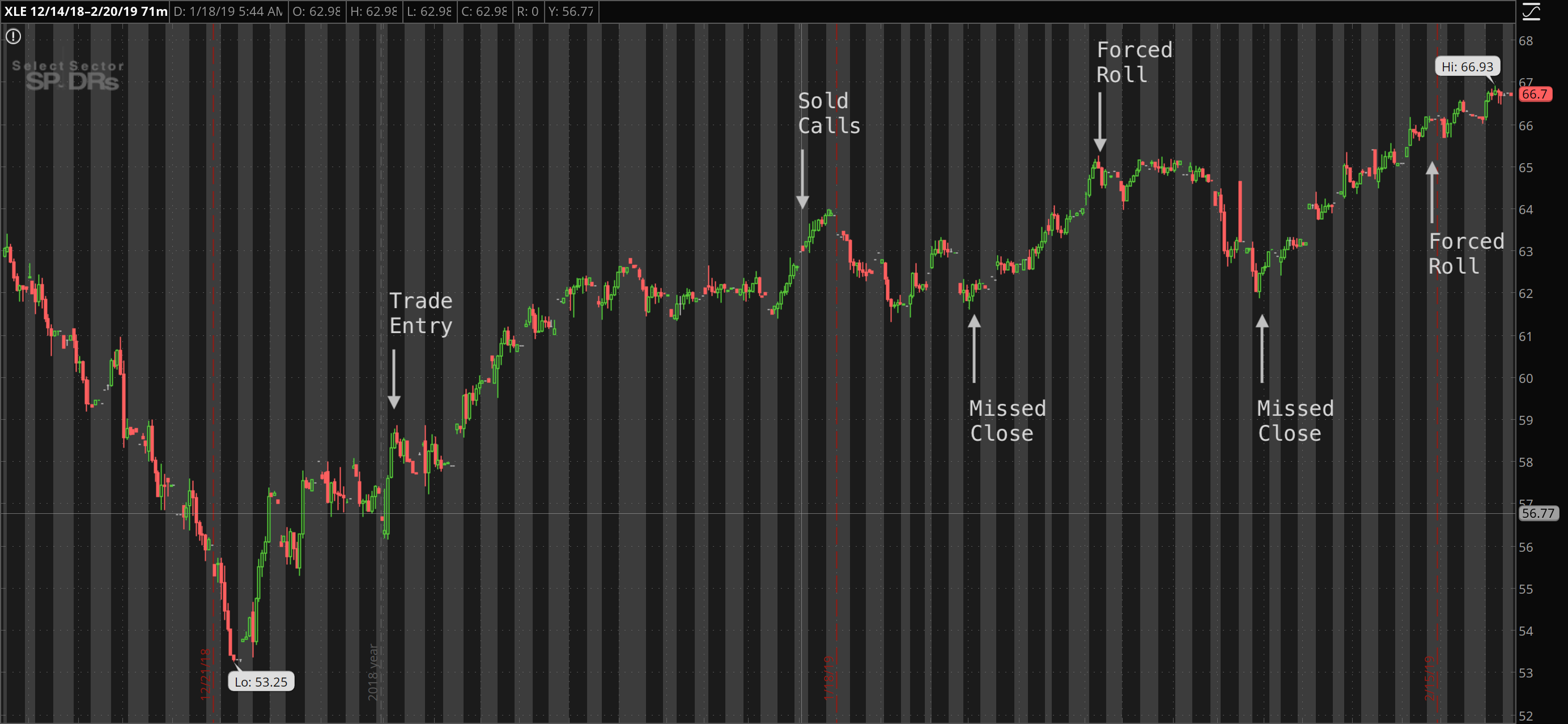

Risk Reversal in XLE

I purchased some long dated March XLE calls back in December 2018. The downside was over done and call options were cheap. The original trade was actually a risk reversal as I sold a put credit spread to finance purchasing the calls.

As the puts expired worthless and XLE continued to move up into February I started selling covered calls. Initially, this looked great as just a few days later XLE dropped down to $62. However, instead of buying back the covered calls, I carried them to expiration. The final week XLE rallied from $62 to $65. While I have been able to roll these into weekly covered calls, I capped my gains as XLE continues to climb.

Short Strangle in IWM

Since last October I have opened short strangles in IWM. This has been a bit painful with the recent V bottom in the market. The swings have prevented me from closing the position as initially the put side is challenged, then the call side is challenged. As such, I've been allowing these trades to go all the way to expiration before closing or rolling for a credit.

Last week, I lost faith and took the opportunity to roll IWM early in the day instead of waiting until right before close. Of course, by the end of the day IWM would have come in perfectly between the strikes for a full profit. Although I did roll for a credit, the problem is with the continued move up the position is challenged again. Since the roll was not for a large credit, the potentially profitable position is now a loser.

Short Strangle in UNP

I had an old price alert out for UNP at $136 which triggered during the December lows. I actually purchased the stock outright in my IRA account given the price drop and decent dividend.

After UNP reported earnings they rebounded to $157 I opened a short strangle between $150 and $165. They lingered in the $150s for week. During that time, I could've taken this position off for roughly a 50% profit. But it never challenged the strikes. In addition, $160 was a 52-week high.

In hindsight, this lingering turned out to be a trap for two reasons. First, it prevented me from tightening the strangle by adjusting the put spread when the calls weren’t challenged. Second, even though UNP trended lower, it was forming a recognizable base.

Into expiration UNP powered from $160 to $172 making a new 52-week high. The combination of the significant move up past the call strikes and limited time remaining prevented me from rolling. Although I adjusted the short strangle into an iron butterfly, I still swung from a 50% profit to a full loser.

Lessons

Timing is hard. I will never time trades perfectly. While I can mitigated this with rolling and adjustments, these trades remind me to take profits when I have them.

In the end, it’s about utility. The thing is these three reviews don't really tell me anything. Next week I could just as easily get the timing right or wrong.

What it boils down to for me is utility. Even if I could make more by taking a trade into expiration, there is more value in closing the position early when profitable. Especially with options trades where the variables are constantly changing.

Find this interesting? Follow me on Twitter for even tips and trades.